UPI limit ₹1 lakh me atak rahi hai? 2025 me daily transfer limit kaise badhaye, simple steps aur bank tricks yahan jane.

Intro

Subah 9 baje ghar ka rent bhejna tha.

Amount ₹65,000.

Phir school fees ₹28,000.

Aur ek urgent payment ₹20,000.

Teesri transaction par phone screen par message aaya — “Daily UPI limit exceeded.”

Payment fail.

Line me khade log.

Aur embarrassment alag.

Aaj kal ye problem hazaaron users face kar rahe hain. Isi liye Google par ek sawaal trend kar raha hai — how to increase UPI limit.

2025 me jab sab kuch digital ho gaya hai, phir bhi limit ka issue kyon?

Aur kya sach me isse badhaya ja sakta hai?

Ground reality thodi different hai.

Chaliye step-by-step samajhte hain.

Background: kya hua, limit issue achanak kyon badh gaya?

India me UPI adoption record level par hai.

Har mahine 1000+ crore se zyada transactions ho rahi hain.

Chhoti chai se lekar lakhon ke payments tak, sab UPI se.

Par problem simple hai.

Default daily limit ₹1 lakh.

Aur ye limit sirf ek app ki nahi hoti.

Aap Google Pay, PhonePe, Paytm sab use karo…

Total mila ke ₹1 lakh hi.

Isliye jab bade payments aate hain — rent, fees, medical bills — log atak jaate hain.

Tabhi search spike karta hai: how to increase UPI limit.

Kaise badla situation: kya 2025 me limit badh sakti hai?

Pehle UPI limit fixed hoti thi.

User kuch nahi kar sakta tha.

Ab banks thode flexible ho gaye hain.

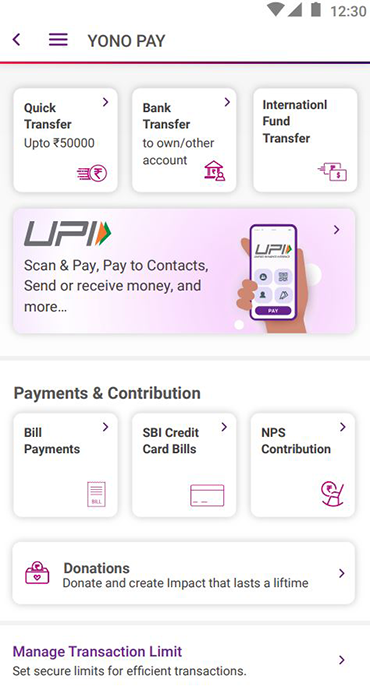

Kai banks apne app me transaction limit setting dene lage hain.

Matlab:

Aap manually request dal sakte ho.

Ya customer care se badhwa sakte ho.

Process usually aisa hota hai:

- Full KYC verify

- Bank app open

- UPI settings

- Increase limit request

- OTP confirm

Kuch banks 24–48 ghante me approve kar dete hain.

Kuch me branch visit lagta hai.

Yahi difference logon ko confuse karta hai.

Experts kya keh rahe hain: safe tareeka kya hai?

Digital finance experts ek clear baat bolte hain.

Limit badhana possible hai, par blindly nahi.

Kyon?

Security risk.

Agar phone hack ho gaya ya fraud hua, to high limit me nuksaan bhi bada hoga.

Isliye banks kuch cheezein check karte hain:

- Full KYC completed

- Stable transaction history

- No fraud record

- Linked bank account active

Agar ye sab clean hai…

Tab approval fast milta hai.

Experts ye bhi suggest karte hain:

Large payments ke liye special categories use karo.

Jaise:

- Education

- Hospital

- Tax

In cases me per transaction ₹2–5 lakh tak allowed hota hai (bank rules ke hisaab se).

Matlab bina daily cap hit kiye payment ho sakta hai.

Public reaction: ground par log kya try kar rahe hain?

Lucknow ke Amit ne rent ke liye payment split kiya.

₹50k + ₹50k.

Kaam ho gaya.

Simple jugad.

Hyderabad ki Pooja ne bank app se limit increase request dali.

2 din me ₹2 lakh daily cap mil gaya.

Par sabka experience smooth nahi.

Kai users bolte hain:

“Customer care response slow hai.”

“App me option hi nahi milta.”

“Request reject ho jati hai bina reason.”

Isliye log safe methods use karte hain:

- Payment next day split karna

- Net banking use karna

- IMPS/NEFT backup rakhna

Yaani UPI convenient hai, par still 100% free nahi.

Aage kya ho sakta hai: future me UPI aur powerful banega?

2025 me digital banking next level par ja raha hai.

Experts expect kar rahe hain:

- Personalized limits

- Instant approval

- One-tap increase

- Smart fraud detection

Matlab system aapke usage ke hisaab se limit set karega.

Heavy users ko higher cap.

New users ko lower.

Yeh model already test phase me hai kuch banks me.

Agar ye fully launch hua…

To “limit exceeded” message history ban sakta hai.

Par tab tak…

Thoda smart rehna zaroori hai.

Conclusion

UPI ne life easy bana di.

Cash almost khatam.

Par jab payment fail hota hai, tab frustration double ho jata hai.

Isliye how to increase UPI limit sirf ek search nahi…

Aaj ke digital user ki real need hai.

Agar aap regular high payments karte ho, to bank se limit request karo.

KYC complete rakho.

Aur backup option ready rakho.

Chhota step hai.

Par financial freedom ke liye bada difference.

Aapki daily UPI limit kabhi aapko beech raste me roki hai?

Ya abhi bhi ₹1 lakh cap se struggle chal raha hai?