Credit card band karna ab online possible hai? 2025 me kaise close kare bina penalty. Step-by-step simple guide yahan padhiye.

Intro

Raat ke 11 baje phone par ek message aata hai.

“Annual fee ₹1499 deducted.”

Aap sochte ho… par maine to ye credit card use hi nahi kiya.

Yahi moment hai jab hazaaron log Google par search karte hain – how to close credit card online.

2025 me ye trend suddenly spike hua hai. Log unnecessary cards band karna chahte hain. Charges se bachna chahte hain. Aur sab ghar baithe online karna chahte hain.

Lekin sawal simple hai.

Kya sach me online close ho jata hai? Ya phir bank aapko ghuma deta hai?

Chaliye ground reality samajhte hain.

Kya hua: achanak log credit card band kyon kar rahe hain?

Pichhle 1 saal me digital payments bahut badhe hain.

UPI aur debit cards ne daily expenses easy bana diye.

Result?

Bahut se logon ke paas 2–3 extra credit cards padhe rehte hain, jo use hi nahi hote.

Phir bhi har saal:

- Annual fee

- GST

- Late fee

- Hidden charges

Automatically lag jate hain.

Ek Delhi based fintech report ke mutabik, lagbhag 30–35% cards inactive hote hain, par log band nahi karte.

Kyon?

Process complicated lagta hai.

Customer care ka wait, branch visit, emails… headache.

Isliye ab sab direct search kar rahe hain – how to close credit card online without calling bank.

Kaise badla situation: ab online closure ka option kaise mila?

2025 me banks ne digital services fast kar di hain.

Almost har major bank ne:

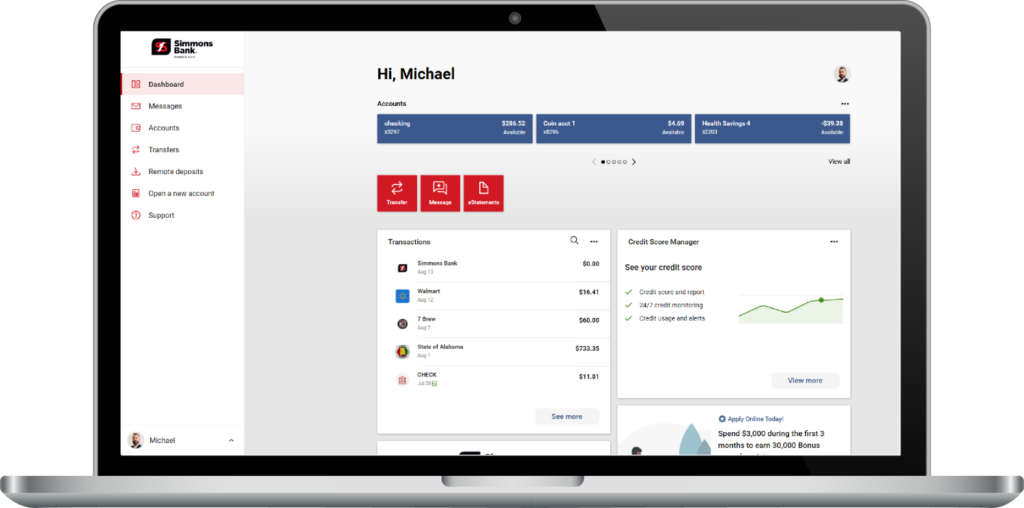

- Net banking

- Mobile app

- Email request

- Chat support

ke through closure option add kiya hai.

Process simple lagta hai.

Par twist yahi hai.

Har bank ka rule alag.

Kisi me 7 din lagte hain.

Kisi me 30 din.

Kahin pe pehle outstanding zero karna compulsory hai.

Step-by-step typical process:

- Outstanding amount clear karo

- Reward points redeem karo

- App me “Close Card” option choose karo

- OTP verify karo

- Written confirmation lo

Agar confirmation nahi mila…

Toh card technically active hi rehta hai.

Aur charges phir lag sakte hain.

Yahi sabse bada trap hai.

Experts kya keh rahe hain: close karne se pehle kya check kare?

Financial planners ek important baat bolte hain.

Credit card band karna hamesha safe nahi hota.

Shock laga?

Reason simple hai.

Credit history.

Agar aapka purana card 5–7 saal purana hai aur achha repayment record hai, to use close karne se:

- Credit score thoda gir sakta hai

- Loan approval me delay ho sakta hai

Isliye experts recommend karte hain:

Pehle ye check karo:

- Kya koi EMI pending hai?

- Auto-payments linked hain?

- Reward points expire honge?

- Credit limit ka kitna impact padega?

Agar sab clear hai, tabhi how to close credit card online ka process start karo.

Public reaction: ground par log kya face kar rahe hain?

Mumbai ke Rohit ne app se request dali.

Unhe laga card band ho gaya.

2 mahine baad phir se annual fee cut gayi.

Kyon?

Closure “request” thi, “confirmation” nahi.

Bangalore ki Sneha ka case alag tha.

Unhone email aur app dono se apply kiya.

7 din me written mail aa gaya.

No extra charge.

Matlab kya?

Process kaafi depend karta hai documentation par.

Log social media par bhi complain kar rahe hain:

“Bank ignore karta hai.”

“Customer care hold pe rakhta hai.”

“Closure delay hota hai.”

Isliye sab log safe method dhund rahe hain.

Aage kya ho sakta hai: 2025 me process aur easy hoga?

Digital banking fast ho raha hai.

RBI guidelines bhi customer-friendly ho rahi hain.

Experts bol rahe hain ki future me:

- One-click closure

- Instant confirmation

- No hidden charges

- 48-hour processing

standard ban sakta hai.

Matlab aap ghar baithe 5 minute me kaam khatam.

Lekin tab tak…

Smart rehna zaroori hai.

Har step ka proof rakho.

Screenshot lo.

Email save karo.

Conclusion

Credit card lena aasaan hota hai.

Band karna thoda tricky.

Par agar aap sahi steps follow karo, to how to close credit card online bilkul possible hai.

Bas jaldi me decision mat lo.

Outstanding clear karo.

Confirmation lo.

Aur apni financial health safe rakho.

2025 me smart users wahi hain jo unnecessary cards hata rahe hain… par samajh ke.

Aapne kabhi apna credit card close karne ki koshish ki hai?

Process smooth tha ya headache bana?

Leave a Comment